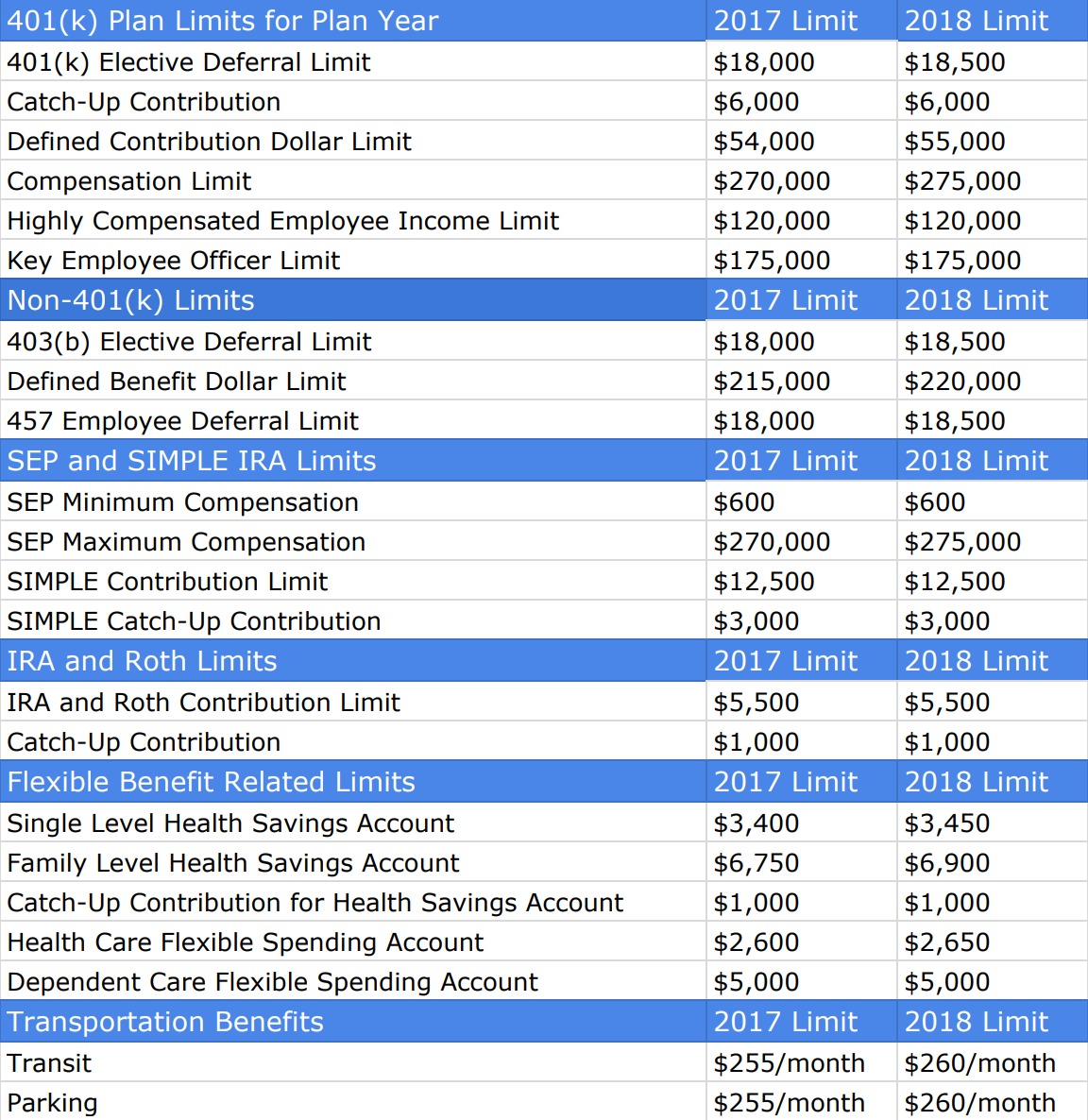

There are limits to how much employers and employees can contribute to a retirement plan, IRA, or flexible spending account each year, and the limits differ widely, depending on the type of plan. After three years at a standstill, the Treasury Department recently raised the limits for contributions to pensions and other retirement plans such as 401(k)s, 403(b)s, 457(b)s, and other similar plans. They also increased contribution limits for a number of flexible benefits. This is great news for employees who take advantage of pre-tax contributions to save money for retirement and on their health care and commuter spending.

The contribution limit to employer-sponsored retirement plans, such as the above-mentioned plans has been $18,000 for calendar 2015, 2016 and 2017. It has finally been raised for 2018, to $18,500. In addition to the retirement limit increase, there are several other benefit limitations for 2018 that were updated, including:

- The overall limit for a 415(c) plan has jumped to $55,000, up from $54,000.

- Defined Benefit Plan Benefit Limits for Annual Benefits were increased from $215,000 to $220,000.

- For SEP IRAs or solo 401(k)s, the amount you can contribute as an employer, as a percentage of your salary goes up from $54,000 to $55,000.

- The Annual Compensation Limit also increases, from $270,000 in 2017 to $275,000 in 2018.

- The Health Savings Account limits have been raised from $3,400 to $3,450 for Single Level Medical Coverage and from $6,750 to $6,900 for Family Level Medical Coverage.

- The yearly limit on employee contributions to their employer-sponsored healthcare flexible spending account (FSA) has increased from $2,600 to $2,650.

- The monthly limitations for commuter benefits was raised to $260 a month from $255 a month for both transit and parking.

Employers should work with their HR and Payroll Team to adjust their contribution settings for the new year and to inform employees about the new limits in their open enrollment materials.

Emplicity understands that HR Outsourcing should be simple and meaningful. As a Professional Employer Organization (PEO), we strive to be a great partner in supporting your business. If you would like to request more information on how we can assist your needs, please reach out to us at 877-476-2339. We are located in California – Orange County, Los Angeles, and the greater Sacramento and San Francisco area.

NOTICE: Emplicity provides HR advice and recommendations. Information provided by Emplicity is not intended as a substitute for employment law counsel. At no time will Emplicity have the authority or right to make decisions on behalf of their clients.